Developments in the steel market

Outlook steel market

For the second half of 2025, the global economy is expected to remains stable. The outlook differs across countries with strong growth in emerging market economies, but less growth especially in Europe (+0,8%*).

Steel demand is expected to slightly increase in 2025, but the outlook for major steel consuming industries in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. This growth is driven by public investments, green transformation and infrastructure projects. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not positive yet. Following the election, Germany however announced huge infrastructure investments. In the manufacturing industry a slight recovery is anticipated in 2025. Nevertheless, the industry is still influenced by current geopolitical uncertainties.

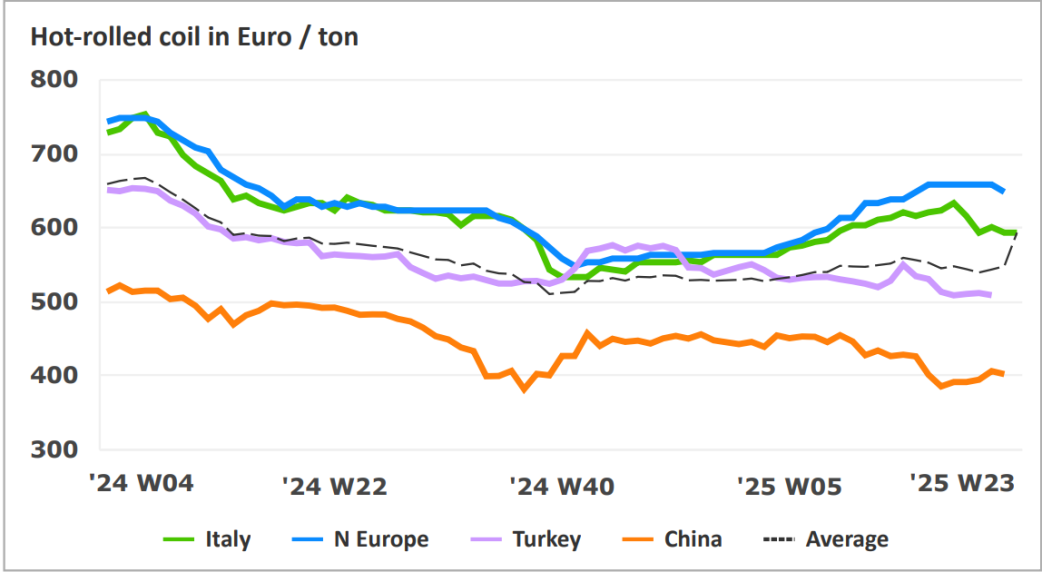

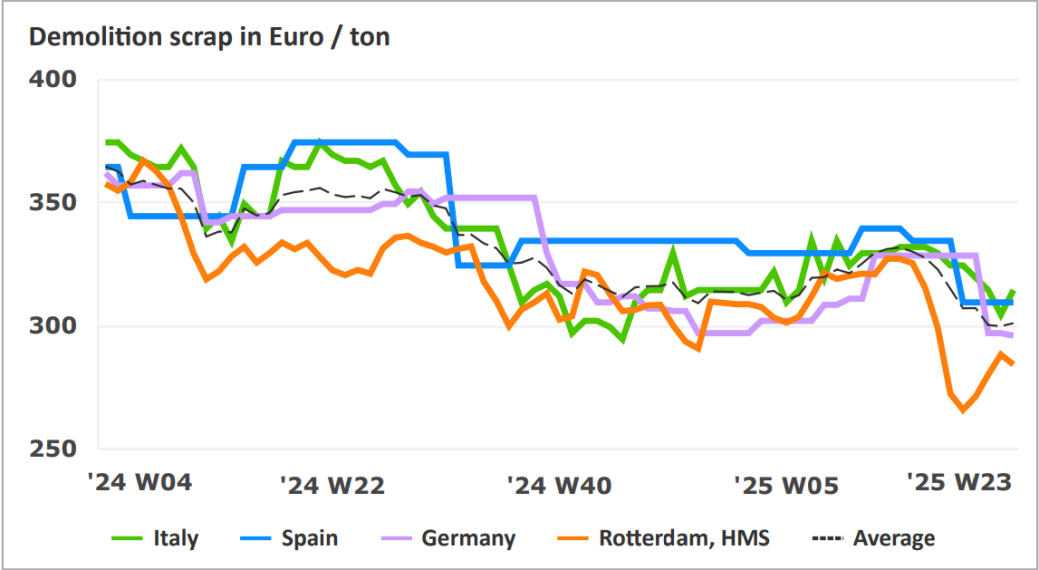

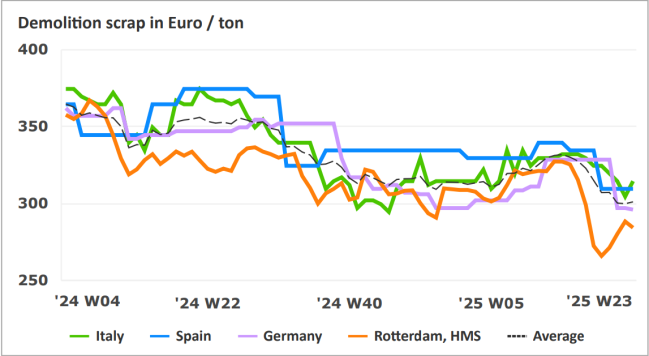

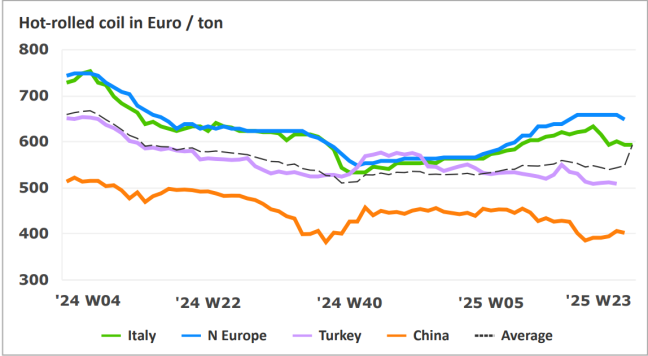

The raw material development is in line with the current market situation, with some minor reductions in scrap prices due to slow demand in the European Union. The price levels for hot-rolled coils increased since the beginning of 2025, which influenced steel tube prices. The coil prices stabilized during the last few weeks. Price developments in the upcoming months depend on the import rates. Delivery times for most pipe and tube product groups have not changed.

Steel demand is expected to slightly increase in 2025, but the outlook for major steel consuming industries in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. This growth is driven by public investments, green transformation and infrastructure projects. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not positive yet. Following the election, Germany however announced huge infrastructure investments. In the manufacturing industry a slight recovery is anticipated in 2025. Nevertheless, the industry is still influenced by current geopolitical uncertainties.

The raw material development is in line with the current market situation, with some minor reductions in scrap prices due to slow demand in the European Union. The price levels for hot-rolled coils increased since the beginning of 2025, which influenced steel tube prices. The coil prices stabilized during the last few weeks. Price developments in the upcoming months depend on the import rates. Delivery times for most pipe and tube product groups have not changed.

*Source: International Monetary Fund from May 2025

Tariffs, safeguard and CBAM

In response to unfair trade practices as well as global overcapacity, the European Commission will introduce new long-term steel safeguards. The Commission announced its Steel and Metals Action Plan in March, aimed at securing competitiveness, and decarbonization of Europe’s steel and metals industries. This includes more protection against dumping and a better functioning of the CO2-regulation. To prevent carbon leakage, the Commission will strengthen CBAM with anti-circumvention measures and extend its scope to downstream steel and aluminium products.

Important news for the steel market is that the United States imposed tariffs of up to 50% on imports of steel, aluminium, and certain products containing steel and aluminium from the European Union. Although the consequences are difficult to predict, this is expected have an impact on global material flows and price levels.

In response to unfair trade practices as well as global overcapacity, the European Commission will introduce new long-term steel safeguards. The Commission announced its Steel and Metals Action Plan in March, aimed at securing competitiveness, and decarbonization of Europe’s steel and metals industries. This includes more protection against dumping and a better functioning of the CO2-regulation. To prevent carbon leakage, the Commission will strengthen CBAM with anti-circumvention measures and extend its scope to downstream steel and aluminium products.

Important news for the steel market is that the United States imposed tariffs of up to 50% on imports of steel, aluminium, and certain products containing steel and aluminium from the European Union. Although the consequences are difficult to predict, this is expected have an impact on global material flows and price levels.

Tariffs, safeguard and CBAM

In response to unfair trade practices as well as global overcapacity, the European Commission will introduce new long-term steel safeguards. The Commission announced its Steel and Metals Action Plan in March, aimed at securing competitiveness, and decarbonization of Europe’s steel and metals industries. This includes more protection against dumping and a better functioning of the CO2-regulation. To prevent carbon leakage, the Commission will strengthen CBAM with anti-circumvention measures and extend its scope to downstream steel and aluminium products.

Important news for the steel market is that the United States imposed tariffs of up to 50% on imports of steel, aluminium, and certain products containing steel and aluminium from the European Union. Although the consequences are difficult to predict, this is expected have an impact on global material flows and price levels.e-impact-on-the-market-for-steel-tube-products/

In response to unfair trade practices as well as global overcapacity, the European Commission will introduce new long-term steel safeguards. The Commission announced its Steel and Metals Action Plan in March, aimed at securing competitiveness, and decarbonization of Europe’s steel and metals industries. This includes more protection against dumping and a better functioning of the CO2-regulation. To prevent carbon leakage, the Commission will strengthen CBAM with anti-circumvention measures and extend its scope to downstream steel and aluminium products.

Important news for the steel market is that the United States imposed tariffs of up to 50% on imports of steel, aluminium, and certain products containing steel and aluminium from the European Union. Although the consequences are difficult to predict, this is expected have an impact on global material flows and price levels.e-impact-on-the-market-for-steel-tube-products/

*Source: International Monetary Fund from May 2025

For the second half of 2025, the global economy is expected to remains stable. The outlook differs across countries with strong growth in emerging market economies, but less growth especially in Europe (+0,8%*).

Steel demand is expected to slightly increase in 2025, but the outlook for major steel consuming industries in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. This growth is driven by public investments, green transformation and infrastructure projects. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not positive yet. Following the election, Germany however announced huge infrastructure investments. In the manufacturing industry a slight recovery is anticipated in 2025. Nevertheless, the industry is still influenced by current geopolitical uncertainties.

The raw material development is in line with the current market situation, with some minor reductions in scrap prices due to slow demand in the European Union. The price levels for hot-rolled coils increased since the beginning of 2025, which influenced steel tube prices. The coil prices stabilized during the last few weeks. Price developments in the upcoming months depend on the import rates. Delivery times for most pipe and tube product groups have not changed.

Steel demand is expected to slightly increase in 2025, but the outlook for major steel consuming industries in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. This growth is driven by public investments, green transformation and infrastructure projects. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not positive yet. Following the election, Germany however announced huge infrastructure investments. In the manufacturing industry a slight recovery is anticipated in 2025. Nevertheless, the industry is still influenced by current geopolitical uncertainties.

The raw material development is in line with the current market situation, with some minor reductions in scrap prices due to slow demand in the European Union. The price levels for hot-rolled coils increased since the beginning of 2025, which influenced steel tube prices. The coil prices stabilized during the last few weeks. Price developments in the upcoming months depend on the import rates. Delivery times for most pipe and tube product groups have not changed.

Outlook steel market

Developments in the steel market