Market developments

The dominant news in the steel market is without doubt the introduction of 25% import duties for steel from the EU by US president Trump. Other countries such as China, Mexico and Canada are also subject to high import duties on steel to the US. Although consequences are still difficult to foresee, the impact on worldwide material flows and price levels can be significant.

In reaction, Eurofer is urging the EU commission to make adjustments to the existing Safeguard quotas, which need to be brought in line with the current market demand. This means a reduction of 15%, as quotas progressed in recent years while demand decreased. Together with the continuation of capped import quotas from third countries, this would lead to a significant reduction of steel imports in the EU - up to 25% compared to 2024 import volumes. This will not only apply to steel pipe material but also to hot rolled coils.

Quite recently, Brussels announced its extensive plan to support the EU steel sector. This not only involves more protection against dumping (mainly from China) and better functioning of the CO2 border regulation (more on that later). It is also about improving the competitiveness of the European steel industry with lower energy tariffs and better access to the congested power grid.

Against the background of these global developments, HRC mills in Europe aim for higher coil prices and recently started to increase their price levels, Arcelor Mittal leading the way.

The outlook for important steel using markets in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not yet positive. Germany registered a second year-on-year decline of orders in mechanical engineering. Based on the outcome of the recent elections in Germany, a change in economy policy can be expected, in order to turn this negative trend around.

For the process industry, we are witnessing a decline in CAPEX investments. Moreover, companies active in this market struggle with their profitability, for which the high energy costs are one of the main reasons.

March 2025

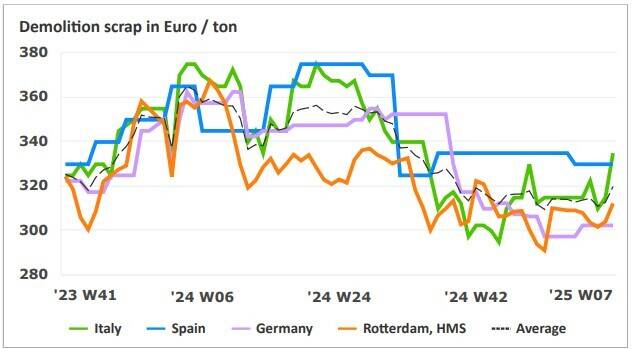

Price development of hot-rolled coil (source Kallanish)

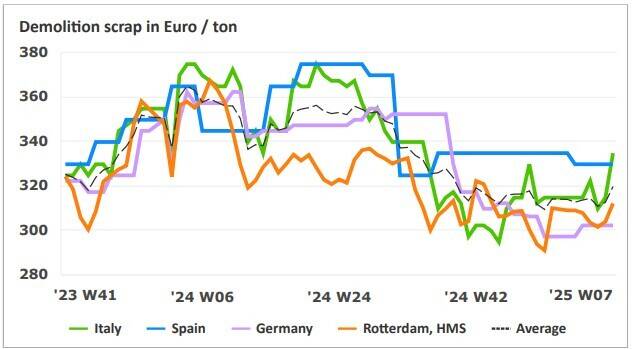

Price development of scrap (source Kallanish)

Sustainability and CBAM news

Above a certain threshold, companies have to pay for carbon emissions they produce or import from outside the EU. The regulation will come into full force in January 2026 and this has not been changed. However, the obligation to pay, i.e. purchase and deposit CBAM certificates over emissions embedded in 2026 imports is postponed until February 2027. To be quite clear: this only means a delay in payment and not a delay of the CBAM regulation itself! Also, a softer penalty regime and a higher threshold for the penalty-free CO2 tonnage are under discussion. All adjustments aim at simplifying the process.

The Royal Van Leeuwen Pipe and Tube Group fully underlines the sustainability goals of the EU and has incorporated 7 SDG’s (Sustainable Development Goals) in its sustainability strategy. Stimulating the production and use of CO2 reduced tubes is an important part of it. Two years ago, we were the first steel tube distributor to stock CO2 reduced tubes in the Netherlands. We sell them under our umbrella brand Van Leeuwen Impact.

We recently increased the Impact stock in Zwijndrecht with an assortment of seamless tubes according to API/ASTM, suitable for applications in energy related markets. Asset owners that are looking for ways to reduce their carbon footprint can now use the Impact tubes to lower their scope 3 emissions for CAPEX investments and MRO activities.

Last month, the European Commission took an important decision “to fund research for breakthrough technologies leading to near-zero-carbon steelmaking, as well as projects for managing the just transition for coal mines”. Read more about this program here: Research Program of the Research Fund for Coal and Steel (RFCS).

This program turns out to be part of a much bigger initiative from the EU which was announced on February 26: the “Clean Industrial Deal”. In this deal the Commission outlines three main objectives: ensure affordable energy, boost the demand for clean products and finance the clean transition. For this last objective, an “industrial decarbonisation bank” of 100 million Euro should be set up. Many companies want to invest in the clean energy transition, they often have very concrete plans, but fail to get the business case positive. This fund will therefore be a very important part to boost the energy transition,

Within these three objectives, more plans have been worked out. On of them is to improve efficiency and effectiveness of the existing CBAM regulation. This Carbon Border Adjustment Mechanism has been created to prevent carbon leakage at EU borders, which could occur by relocating carbon intensive production to less carbon-regulated countries. It should also stimulate more sustainable production methods within the EU.

Availability and delivery times

Due to low demand, many mills run on reduced capacity or shut capacity down. This does not affect the delivery times of most pipe and tube products, which are in general still normal. However, there can be exceptions as mills have to adjust their rolling schedules due to the capacity reduction. The overall availability of pipe and tube material is good.

Cost for packaging goes up

Prices for wood have risen significantly over the last few months. This will influence the cost for packaging pipes, fittings and flanges in wood or cardboard.

Price developments of carbon steel products

Mills of welded tubes are still facing low demand levels to which they respond by lowering or closing production capacity. However, as HRC producers such as Arcelor Mittal seized the momentum to announce and implement price increases, various welded tube mills raised their prices as well (by € 10-20/ton). Although market conditions remain turbulent and predictions are difficult, the overall estimation is that price levels will go up in the coming months.

Demand for seamless tubes is slow as well, especially for heavy wall tubes used in the mechanical industry. Mills struggle with their profitability due to the increased energy cost (both gas and electricity) as well as increased scrap prices. Overall, prices for seamless tubes are expected to remain stable for the coming period.

We don’t see remarkable changes in the market for fittings and flanges yet. Here, EU mills are also faced with the 25% tariff for export to the USA, a market which has been important for the producers. No doubt there will be consequences, but it is too early to know what effect they will have. In the near future we expect prices to remain stable.

Royal Van Leeuwen More than tubes.

Van Leeuwen Buizen Groep B.V.

Adres:

Telefoon:

E-mail:

Lindtsedijk 120, 3336 LE Zwijndrecht

078 625 25 25

vlptg@vanleeuwen.nl

Van Leeuwen

More than tubes.

Lindtsedijk 100, 3336 LE Zwijndrecht, Netherlands

+31 78 625 25 25

sales@vanleeuwen.nl

www.vanleeuwen.com

P. van Leeuwen Jr.'s Buizenhandel B.V.

Address:

Phone:

E-mail:

Web:

Never want to miss a Pipe and Tube Market Review and want to be the first to read it each quarter? Then follow us on LinkedIn!

© Royal Van Leeuwen 2025

Above a certain threshold, companies have to pay for carbon emissions they produce or import from outside the EU. The regulation will come into full force in January 2026 and this has not been changed. However, the obligation to pay, i.e. purchase and deposit CBAM certificates over emissions embedded in 2026 imports is postponed until February 2027. To be quite clear: this only means a delay in payment and not a delay of the CBAM regulation itself! Also, a softer penalty regime and a higher threshold for the penalty-free CO2 tonnage are under discussion. All adjustments aim at simplifying the process.

The Royal Van Leeuwen Pipe and Tube Group fully underlines the sustainability goals of the EU and has incorporated 7 SDG’s (Sustainable Development Goals) in its sustainability strategy. Stimulating the production and use of CO2 reduced tubes is an important part of it. Two years ago, we were the first steel tube distributor to stock CO2 reduced tubes in the Netherlands. We sell them under our umbrella brand Van Leeuwen Impact.

We recently increased the Impact stock in Zwijndrecht with an assortment of seamless tubes according to API/ASTM, suitable for applications in energy related markets. Asset owners that are looking for ways to reduce their carbon footprint can now use the Impact tubes to lower their scope 3 emissions for CAPEX investments and MRO activities.

Cost for packaging goes up

Prices for wood have risen significantly over the last few months. This will influence the cost for packaging pipes, fittings and flanges in wood or cardboard.

Sustainability and CBAM news

Last month, the European Commission took an important decision “to fund research for breakthrough technologies leading to near-zero-carbon steelmaking, as well as projects for managing the just transition for coal mines”. Read more about this program here: Research Program of the Research Fund for Coal and Steel (RFCS).

This program turns out to be part of a much bigger initiative from the EU which was announced on February 26: the “Clean Industrial Deal”. In this deal the Commission outlines three main objectives: ensure affordable energy, boost the demand for clean products and finance the clean transition. For this last objective, an “industrial decarbonisation bank” of 100 million Euro should be set up. Many companies want to invest in the clean energy transition, they often have very concrete plans, but fail to get the business case positive. This fund will therefore be a very important part to boost the energy transition,

Within these three objectives, more plans have been worked out. On of them is to improve efficiency and effectiveness of the existing CBAM regulation. This Carbon Border Adjustment Mechanism has been created to prevent carbon leakage at EU borders, which could occur by relocating carbon intensive production to less carbon-regulated countries. It should also stimulate more sustainable production methods within the EU.

Availability and delivery times

Due to low demand, many mills run on reduced capacity or shut capacity down. This does not affect the delivery times of most pipe and tube products, which are in general still normal. However, there can be exceptions as mills have to adjust their rolling schedules due to the capacity reduction. The overall availability of pipe and tube material is good.

Price developments of carbon steel products

Mills of welded tubes are still facing low demand levels to which they respond by lowering or closing production capacity. However, as HRC producers such as Arcelor Mittal seized the momentum to announce and implement price increases, various welded tube mills raised their prices as well (by € 10-20/ton). Although market conditions remain turbulent and predictions are difficult, the overall estimation is that price levels will go up in the coming months.

Demand for seamless tubes is slow as well, especially for heavy wall tubes used in the mechanical industry. Mills struggle with their profitability due to the increased energy cost (both gas and electricity) as well as increased scrap prices. Overall, prices for seamless tubes are expected to remain stable for the coming period.

We don’t see remarkable changes in the market for fittings and flanges yet. Here, EU mills are also faced with the 25% tariff for export to the USA, a market which has been important for the producers. No doubt there will be consequences, but it is too early to know what effect they will have. In the near future we expect prices to remain stable.

Price development of hot-rolled coil (source Kallanish)

Price development of scrap (source Kallanish)

Market developments

The dominant news in the steel market is without doubt the introduction of 25% import duties for steel from the EU by US president Trump. Other countries such as China, Mexico and Canada are also subject to high import duties on steel to the US. Although consequences are still difficult to foresee, the impact on worldwide material flows and price levels can be significant.

In reaction, Eurofer is urging the EU commission to make adjustments to the existing Safeguard quotas, which need to be brought in line with the current market demand. This means a reduction of 15%, as quotas progressed in recent years while demand decreased. Together with the continuation of capped import quotas from third countries, this would lead to a significant reduction of steel imports in the EU - up to 25% compared to 2024 import volumes. This will not only apply to steel pipe material but also to hot rolled coils.

Quite recently, Brussels announced its extensive plan to support the EU steel sector. This not only involves more protection against dumping (mainly from China) and better functioning of the CO2 border regulation (more on that later). It is also about improving the competitiveness of the European steel industry with lower energy tariffs and better access to the congested power grid.

Against the background of these global developments, HRC mills in Europe aim for higher coil prices and recently started to increase their price levels, Arcelor Mittal leading the way.

The outlook for important steel using markets in the EU varies. For the construction market, the forecast for 2025 shows growth again, especially in Spain, the Netherlands, Austria and Poland. The outlook for the automotive Industry and the mechanical engineering sector in the EU is not yet positive. Germany registered a second year-on-year decline of orders in mechanical engineering. Based on the outcome of the recent elections in Germany, a change in economy policy can be expected, in order to turn this negative trend around.

For the process industry, we are witnessing a decline in CAPEX investments. Moreover, companies active in this market struggle with their profitability, for which the high energy costs are one of the main reasons.

© Royal Van Leeuwen 2025

Royal Van Leeuwen More than tubes.

Lindtsedijk 120, 3336 LE Zwijndrecht

078 625 25 25

vlptg@vanleeuwen.nl

March 2025