Van Leeuwen is open during the summer

Contrary to many pipe mills, Van Leeuwen stays open all summer. So don’t hesitate to contact us for your pipe and tube needs during the coming months. Our stocks are prepared to bridge the gap when pipe mills shut down for summer.

Market developments

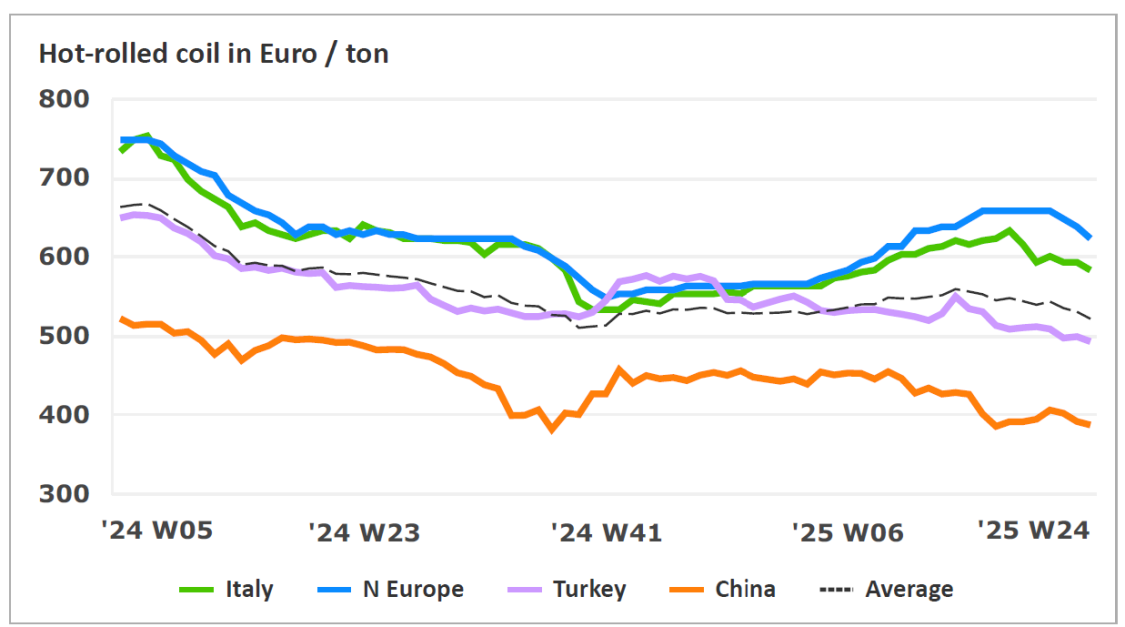

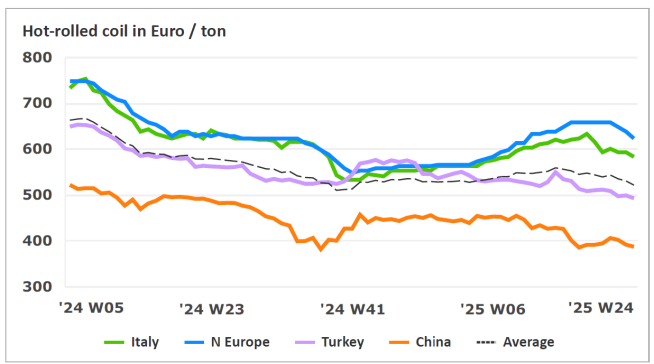

The demand for steel in Europe has not improved in the past few months. Despite capacity reductions by steel mills, the price for hot rolled coils has further declined. Low priced (USD rate) imports put the price under pressure. Despite the fact that Chinese mills are also forced to reduce their capacity, the worldwide overcapacity is still eminent. Chinese steel production and export has doubled in size over the last 4 years, according to a recent OESO report. This growth has been largely subsidized by the government. An also increasing number of antidumping measures by the EU is the only way to limit the pressure of low priced Chinese steel imports into the EU.

On the other hand, we may see an upward price pressure in Q4 when CBAM payments become incorporated in flat-rolled steel pricing. In our previous report we extensively described the CBAM mechanism.

President Trump announced to increase the tariff on Steel and Aluminum from 25% to 50%. The impact of this announcement remains to be seen, as the USA production base for tubes does not cover the demand, regarding both quantity and quality. Therefore, imports will remain necessary. EU mills exporting to the USA haven’t been confronted with cancellation of existing orders, but see a slowdown in their new order intake.

The German export of cars to the USA has declined due to the imposed tariffs, and this negatively affects the automotive industry in this country. For manufacturers of agricultural machines, the situation is the same. Compensation might come from increasing investments in the defense industry, which has a strong production base in Germany.

Other steel consuming sectors in the EU are also suffering from the imposed USA import tariffs, and also from the ongoing effects of the Russia-Ukraine war and the escalating global geopolitical tensions, according to Kallanish. For example, the EU mechanical engineering sector has shown a decline in output for five consecutive quarters.

June 2025

Price development of hot-rolled coil (source Kallanish)

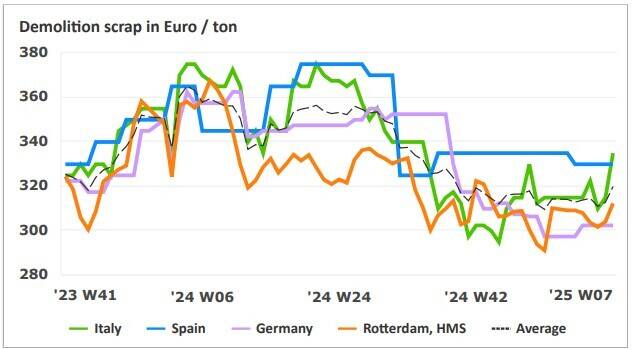

Price development of scrap (source Kallanish)

Sustainability news

Due to the challenging market situation, uncertain perspectives and a still developing demand for sustainable steel, steel manufacturers struggle with the huge investments they planned to make their production methods more sustainable. Some mills have been forced to take a pause and put certain investments on hold.

This does not change our conviction, however, that this is the way forward. Van Leeuwen therefore continues to invest in expanding its stocks of CO2 reduced steel tubes under its brand Van Leeuwen Impact. Together with other initiatives such as using HVO100 biofuel for our transport to customers, we aim to be the greenest pipe and tube distributor in the world by 2030.

Availability and delivery times

Despite the temporary breakdown of a leading mill for seamless tubes, availability and delivery times are still normal across the board. Our stocks are on the desired level and we are prepared for the closure of mills during the coming summer holidays.

Transport Cost

The increasing political tensions in the Middle East could well have a price increasing effect from a transport point of view. More and more ships avoid the Suez Canal and choose the longer – more expensive - route via Cape of Good Hope. This could be problematic for Asian steel exports to Europe, thus giving European producers a slight price advantage.

Price developments of carbon steel products

Different developments in the market for seamless carbon steel tubes have price increasing or decreasing effects, and almost keep each other in balance. Upward price pressure comes from further increasing energy cost and the breakdown of a leading mill for seamless tubes. This could take weeks or months to repair and might lead to temporary shortages. Downward price pressure is caused by ongoing low demand and the declining exports to the USA. So far, mills for seamless tubes react with a wait-and-see attitude, leading to a stable price level on the short term. However, as the order intake at the mills is good and delivery times are going up, we expect a slight price increase in the near future.

The anti-dumping case against Chinese carbon steel seamless tubes has been officially withdrawn. A new investigation is expected soon.

For welded carbon steel tubes the price pressure goes on, caused by the afore mentioned price decrease of hot rolled coils. HRC mills keep reducing prices in this highly competitive market, ensuring an acceptable workload while sacrificing margins. Recently, scrap prices also showed a price decline, as shown in the above graph.

The price level for carbon steel fittings and flanges mostly follows the one for pipes and tubes, so we don’t expect significant changes on the short term.

Royal Van Leeuwen More than tubes.

Van Leeuwen Buizen Groep B.V.

Adres:

Telefoon:

E-mail:

Lindtsedijk 120, 3336 LE Zwijndrecht

078 625 25 25

vlptg@vanleeuwen.nl

Van Leeuwen

More than tubes.

Lindtsedijk 100, 3336 LE Zwijndrecht, Netherlands

+31 78 625 25 25

sales@vanleeuwen.nl

www.vanleeuwen.com

P. van Leeuwen Jr.'s Buizenhandel B.V.

Address:

Phone:

E-mail:

Web:

Never want to miss a Pipe and Tube Market Review and want to be the first to read it each quarter? Then follow us on LinkedIn!

© Royal Van Leeuwen 2025

Due to the challenging market situation, uncertain perspectives and a still developing demand for sustainable steel, steel manufacturers struggle with the huge investments they planned to make their production methods more sustainable. Some mills have been forced to take a pause and put certain investments on hold.

This does not change our conviction, however, that this is the way forward. Van Leeuwen therefore continues to invest in expanding its stocks of CO2 reduced steel tubes under its brand Van Leeuwen Impact. Together with other initiatives such as using HVO100 biofuel for our transport to customers, we aim to be the greenest pipe and tube distributor in the world by 2030.

Transport Cost

The increasing political tensions in the Middle East could well have a price increasing effect from a transport point of view. More and more ships avoid the Suez Canal and choose the longer – more expensive - route via Cape of Good Hope. This could be problematic for Asian steel exports to Europe, thus giving European producers a slight price advantage.

Sustainability news

Last month, the European Commission took an important decision “to fund research for breakthrough technologies leading to near-zero-carbon steelmaking, as well as projects for managing the just transition for coal mines”. Read more about this program here: Research Program of the Research Fund for Coal and Steel (RFCS).

This program turns out to be part of a much bigger initiative from the EU which was announced on February 26: the “Clean Industrial Deal”. In this deal the Commission outlines three main objectives: ensure affordable energy, boost the demand for clean products and finance the clean transition. For this last objective, an “industrial decarbonisation bank” of 100 million Euro should be set up. Many companies want to invest in the clean energy transition, they often have very concrete plans, but fail to get the business case positive. This fund will therefore be a very important part to boost the energy transition,

Within these three objectives, more plans have been worked out. On of them is to improve efficiency and effectiveness of the existing CBAM regulation. This Carbon Border Adjustment Mechanism has been created to prevent carbon leakage at EU borders, which could occur by relocating carbon intensive production to less carbon-regulated countries. It should also stimulate more sustainable production methods within the EU.

Availability and delivery times

Despite the temporary breakdown of a leading mill for seamless tubes, availability and delivery times are still normal across the board. Our stocks are on the desired level and we are prepared for the closure of mills during the coming summer holidays.

Price developments of carbon steel products

Different developments in the market for seamless carbon steel tubes have price increasing or decreasing effects, and almost keep each other in balance. Upward price pressure comes from further increasing energy cost and the breakdown of a leading mill for seamless tubes. This could take weeks or months to repair and might lead to temporary shortages. Downward price pressure is caused by ongoing low demand and the declining exports to the USA. So far, mills for seamless tubes react with a wait-and-see attitude, leading to a stable price level on the short term. However, as the order intake at the mills is good and delivery times are going up, we expect a slight price increase in the near future.

The anti-dumping case against Chinese carbon steel seamless tubes has been officially withdrawn. A new investigation is expected soon.

For welded carbon steel tubes the price pressure goes on, caused by the afore mentioned price decrease of hot rolled coils. HRC mills keep reducing prices in this highly competitive market, ensuring an acceptable workload while sacrificing margins. Recently, scrap prices also showed a price decline, as shown in the above graph.

The price level for carbon steel fittings and flanges mostly follows the one for pipes and tubes, so we don’t expect significant changes on the short term.

Price development of hot-rolled coil (source Kallanish)

Price development of scrap (source Kallanish)

Market developments

The demand for steel in Europe has not improved in the past few months. Despite capacity reductions by steel mills, the price for hot rolled coils has further declined. Low priced (USD rate) imports put the price under pressure. Despite the fact that Chinese mills are also forced to reduce their capacity, the worldwide overcapacity is still eminent. Chinese steel production and export has doubled in size over the last 4 years, according to a recent OESO report. This growth has been largely subsidized by the government. An also increasing number of antidumping measures by the EU is the only way to limit the pressure of low priced Chinese steel imports into the EU.

On the other hand, we may see an upward price pressure in Q4 when CBAM payments become incorporated in flat-rolled steel pricing. In our previous report we extensively described the CBAM mechanism.

President Trump announced to increase the tariff on Steel and Aluminum from 25% to 50%. The impact of this announcement remains to be seen, as the USA production base for tubes does not cover the demand, regarding both quantity and quality. Therefore, imports will remain necessary. EU mills exporting to the USA haven’t been confronted with cancellation of existing orders, but see a slowdown in their new order intake.

The German export of cars to the USA has declined due to the imposed tariffs, and this negatively affects the automotive industry in this country. For manufacturers of agricultural machines, the situation is the same. Compensation might come from increasing investments in the defense industry, which has a strong production base in Germany.

Other steel consuming sectors in the EU are also suffering from the imposed USA import tariffs, and also from the ongoing effects of the Russia-Ukraine war and the escalating global geopolitical tensions, according to Kallanish. For example, the EU mechanical engineering sector has shown a decline in output for five consecutive quarters.

© Royal Van Leeuwen 2025

Royal Van Leeuwen More than tubes.

Lindtsedijk 120, 3336 LE Zwijndrecht

078 625 25 25

vlptg@vanleeuwen.nl

June 2025