Back to index

The situation on the European steel market will continue to be volatile and price adjustments are following each other in rapid succession. In the past we were able to plan six months ahead with relative certainty. However, nowadays the situation is changing on a monthly and even on a weekly basis. Our strong relationships and long-term supplier agreements therefore have become more important than ever. By staying focused on the long-term, we will continue to be able to effectively serve our customers.

We are looking forward to a very interesting 2022!

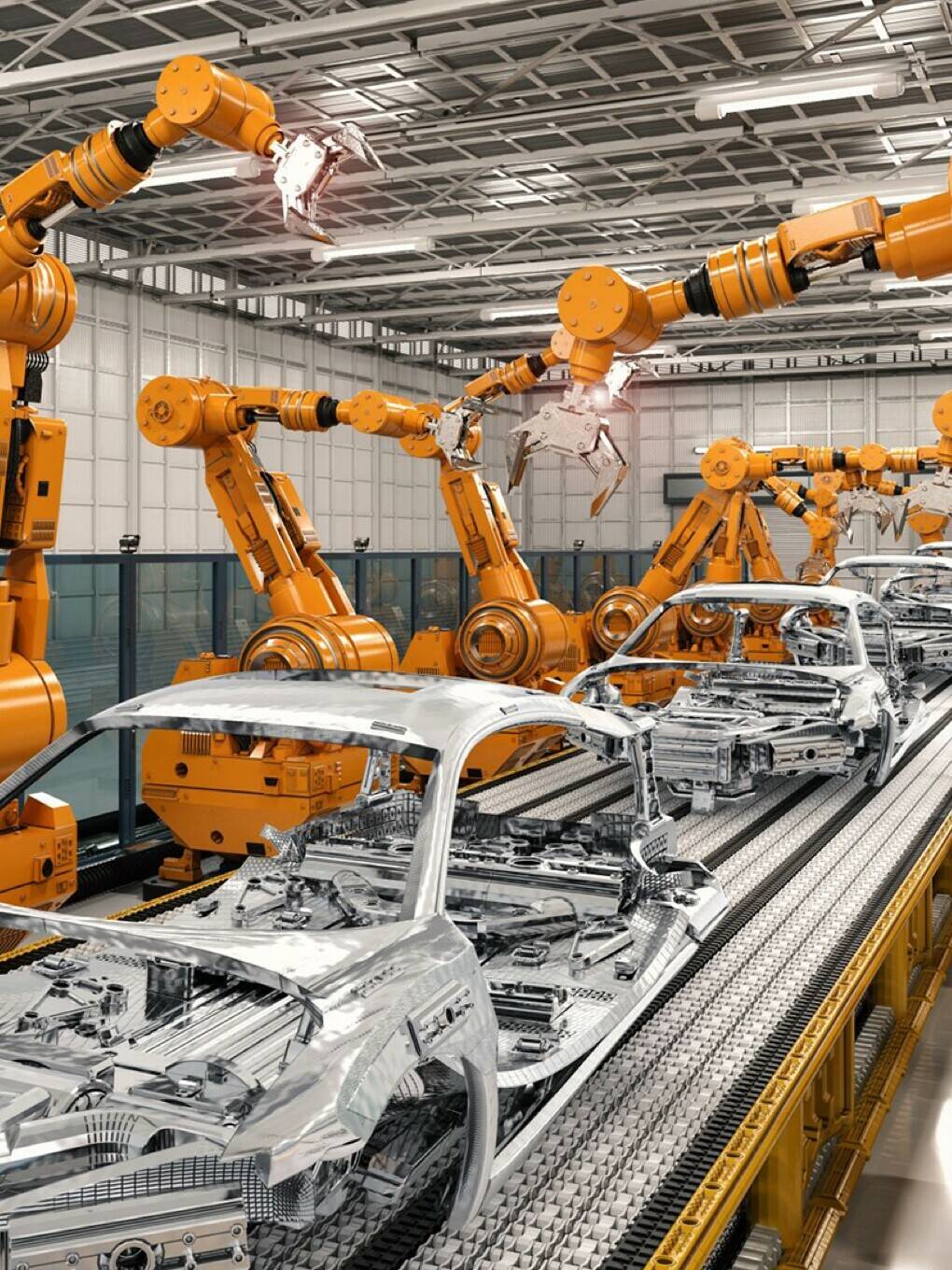

Car manufacturers still have well-stocked order books and ultimately will once again require a lot of crude steel, resulting in renewed shortages and price increases. The timing of this is uncertain. Predictions vary from the second quarter of 2022 to mid-2023. The price of hot-rolled coil doubled between November 2020 and July 2021, but is expected to stay stable over the coming quarter. The high prices of pre-materials, high production costs (energy, gas) and import restrictions are keeping prices stable.

The partial stabilization of prices and availability are reason for optimism, although the outlook remains uncertain. It is expected that the shortage of truck drivers will persist. This delays the transport of materials to factories and the delivery of products to our customers. Should demand once again increase deliveries may suffer further delays. Aside from this, political developments play an important role. Should the United States relinquish its import restrictions, the demand for European steel is expected to once again significantly increase, because exports to the US are then expected to once again increase as well.

However, in the last quarter, the automotive sector was hard hit by a shortage of semi-conductor chips. Due to uncertain chip delivery times, car manufacturers canceled orders from steel factories. The canceled orders have since been put on the market as freely available stock. As a result the availability and price of hot-rolled coil stabilized.

Generally speaking, factories have difficulty acquiring pre-materials, as a result of which production is declining. Dependence on European production further increased last quarter. China terminated its 13 percent subsidy on exports from its steel factories. As a consequence the prices of materials coming from China increased and this, combined with long delivery lead times and an exponential increase in transportation costs, resulted in reduced imports and a higher demand for European steel. Except for the automotive sector where there is a temporary decrease in demand, this is creating upward pressures on prices in almost all sectors, such as for stainless steel and precision materials.

The major shortage of truck drivers in Europe, the high cost of fuel and the extremely high energy costs are having a damping effect in the CS welded segment. It is also creating additional price increases in many other product categories.

Managing Director Germany and Austria & Procurement Manager Europe

Back to index

Earlier this year, the increased demand for construction, mechanical engineering and automotive materials created a shortage and increasing prices for hot-rolled carbon steel coil (the basic material used for welded pipes and tubes). The EU’s import quota restrictions reinforced this effect.

in the steel market

Back to index

Earlier this year, the increased demand for construction, mechanical engineering and automotive materials created a shortage and increasing prices for hot-rolled carbon steel coil (the basic material used for welded pipes and tubes). The EU’s import quota restrictions reinforced this effect.

Back to index

in the steel market

Managing Director Germany and Austria & Procurement Manager Europe

Car manufacturers still have well-stocked order books and ultimately will once again require a lot of crude steel, resulting in renewed shortages and price increases. The timing of this is uncertain. Predictions vary from the second quarter of 2022 to mid-2023. The price of hot-rolled coil doubled between November 2020 and July 2021, but is expected to stay stable over the coming quarter. The high prices of pre-materials, high production costs (energy, gas) and import restrictions are keeping prices stable.

The partial stabilization of prices and availability are reason for optimism, although the outlook remains uncertain. It is expected that the shortage of truck drivers will persist. This delays the transport of materials to factories and the delivery of products to our customers. Should demand once again increase deliveries may suffer further delays. Aside from this, political developments play an important role. Should the United States relinquish its import restrictions, the demand for European steel is expected to once again significantly increase, because exports to the US are then expected to once again increase as well.

However, in the last quarter, the automotive sector was hard hit by a shortage of semi-conductor chips. Due to uncertain chip delivery times, car manufacturers canceled orders from steel factories. The canceled orders have since been put on the market as freely available stock. As a result the availability and price of hot-rolled coil stabilized.

Generally speaking, factories have difficulty acquiring pre-materials, as a result of which production is declining. Dependence on European production further increased last quarter. China terminated its 13 percent subsidy on exports from its steel factories. As a consequence the prices of materials coming from China increased and this, combined with long delivery lead times and an exponential increase in transportation costs, resulted in reduced imports and a higher demand for European steel. Except for the automotive sector where there is a temporary decrease in demand, this is creating upward pressures on prices in almost all sectors, such as for stainless steel and precision materials.

The major shortage of truck drivers in Europe, the high cost of fuel and the extremely high energy costs are having a damping effect in the CS welded segment. It is also creating additional price increases in many other product categories.

The situation on the European steel market will continue to be volatile and price adjustments are following each other in rapid succession. In the past we were able to plan six months ahead with relative certainty. However, nowadays the situation is changing on a monthly and even on a weekly basis. Our strong relationships and long-term supplier agreements therefore have become more important than ever. By staying focused on the long-term, we will continue to be able to effectively serve our customers.

We are looking forward to a very interesting 2022!